A Lesson in Personal Finance: Sarah’s Journey to Peace of Mind

Struggling with finances can be overwhelming, but effective budgeting and debt management can lead to financial wellness. Discover Sarah's journey to reclaim control and peace of mind.

Sarah had always been cautious with her money, but lately, it seemed like her personal finance was spiraling out of control. The once-manageable credit card bills had grown into a mountain of debt, and her savings account had dwindled to nearly nothing. As the bills piled up and the anxiety crept in, Sarah found herself consumed by constant worry, struggling to focus on anything else.

Keywords: personal finance, budgeting, emergency fund, debt management, financial therapy, financial wellness, mental health, financial literacy, financial empowerment, investment, savings, credit cards, mindfulness, financial anxiety, financial stability, financial transformation, financial education, financial coaching

It was a freezing winter night when Sarah finally decided to take action. Curled up on her couch, she stared at the stack of envelopes on her coffee table, the ominous red stamps taunting her. “Enough is enough,” she thought, her resolve hardening. With a deep breath, she began to sort through the mess, determined to regain control of her personal finance and, ultimately, her peace of mind.

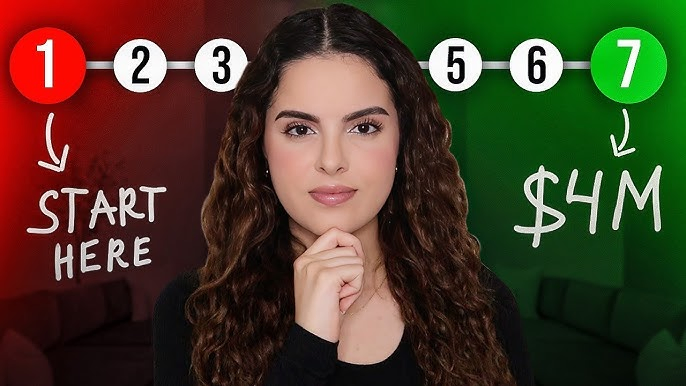

Budgeting for a Brighter Future

Sarah started by creating a detailed budget, painstakingly tracking every single expense. She divided her spending into categories like rent, utilities, groceries, and discretionary purchases, determined to uncover where her money was going. The process was tedious, but as she pored over the numbers, a clearer picture began to emerge.

“I had no idea how much I was spending on eating out or impulse purchases,” Sarah admitted, shaking her head in disbelief. “It’s no wonder I was constantly short on cash.”

Determined to turn things around, Sarah set to work cutting back on unnecessary expenses. She packed her lunch for work, opting for homemade meals instead of expensive takeout. She also canceled a few subscription services she had forgotten about, freeing up additional funds each month.

As Sarah’s budgeting skills sharpened, she began to see the fruits of her labor. By the end of the first month, she had managed to put a few hundred dollars into her savings account – a modest victory, but one that filled her with a sense of accomplishment.

“It felt like I could finally breathe again,” Sarah recalled, a small smile spreading across her face. “I had a plan, and for the first time in a long time, I felt in control of my personal finance.”

Building an Emergency Fund: A Safeguard Against Uncertainty

With her budgeting system in place, Sarah shifted her focus to building an emergency fund. She had heard financial experts recommend setting aside three to six months’ worth of living expenses, but the prospect of amassing such a significant sum seemed daunting.

“The idea of having that kind of cushion was both exciting and terrifying,” Sarah admitted. “I wanted the security, but the thought of actually getting there felt impossible.”

Undeterred, Sarah broke down the goal into smaller, more manageable steps. She set a target of saving $100 per month, a seemingly attainable figure that would slowly but surely build up her emergency fund. To make it happen, she opted to have the money automatically transferred from her checking account to her savings each payday, ensuring the savings happened without her even thinking about it.

As the months passed, Sarah watched her emergency fund grow, and with it, her sense of financial stability. Whenever an unexpected expense arose, like a car repair or a medical bill, she was able to dip into her savings without the panic and stress that had once consumed her.

“It was such a relief to have that safety net,” Sarah reflected. “Instead of worrying about how I was going to pay for things, I could focus on finding solutions. It gave me a whole new perspective on my personal finance.”

Tackling Debt: A Gradual Climb to Freedom

While building her emergency fund was a significant achievement, Sarah knew that the looming specter of debt still weighed heavily on her mind. Determined to free herself from its grip, she set her sights on a comprehensive debt-reduction strategy.

Sarah began by scrutinizing her credit card statements, identifying the balances with the highest interest rates. She then prioritized paying down those balances first, funneling as much extra money as she could towards those high-interest debts each month.

“It was tough, having to forego some of the things I enjoyed to put that money towards my debt,” Sarah admitted. “But I knew it was necessary if I wanted to regain control of my financial future.”

As she chipped away at the balances, Sarah also explored options for debt consolidation and refinancing. By negotiating with her creditors and researching various loan products, she was able to secure more favorable terms, reducing her monthly payments and the overall interest she would pay over time.

The process was not without its challenges, but Sarah remained steadfast in her determination. She celebrated each milestone, whether it was paying off a credit card or reaching a new debt-reduction goal. And as the balances gradually decreased, Sarah could feel the weight on her shoulders lifting.

“It was like a weight had been lifted off my chest,” she recalled. “I could finally see the light at the end of the tunnel, and that gave me the motivation to keep going.”

Investing in Emotional Well-Being

Throughout her financial transformation, Sarah realized that the journey was not just about the numbers – it was also about her emotional and mental well-being. The stress and anxiety she had experienced had taken a significant toll, and she knew she needed to address those psychological aspects as well.

Seeking out a financial therapist, Sarah began to unpack the deeper emotions and behaviors that had contributed to her financial struggles. Together, they explored the ways in which her upbringing and past experiences had shaped her relationship with money, shedding light on the patterns and beliefs that had been holding her back.

“It was eye-opening to realize how much my emotions and mental state were influencing my financial decisions,” Sarah admitted. “I had always thought of money as this purely logical thing, but the therapist helped me see that there was so much more to it.”

Through their sessions, Sarah learned to cultivate a healthier mindset around money, reframing it as a tool for achieving her goals and supporting her overall well-being. She also discovered the power of mindfulness practices, which helped her manage the anxiety and stress that had previously been so overwhelming.

“I started doing daily meditations and journaling about my personal finance,” Sarah shared. “It made a huge difference in how I was able to approach the challenges and stay focused on the positive progress I was making.”

As Sarah’s financial and mental health began to align, she found a newfound sense of confidence and control. The once-daunting tasks of budgeting, saving, and debt management became more manageable, and she even found herself exploring investment opportunities to build long-term wealth.

“I never thought I’d be the kind of person who enjoyed talking about stocks and bonds,” Sarah laughed. “But now, it’s actually kind of exciting to think about my financial future and all the possibilities that are open to me.”

Empowering Others Through Financial Wellness

With her newfound financial stability and emotional well-being, Sarah felt a growing desire to share her story and help others who might be struggling with similar challenges. She began volunteering at a local financial literacy center, offering workshops and one-on-one coaching to community members in need.

“It’s so rewarding to see the light bulb go off for someone when they realize they have the power to take control of their personal finance,” Sarah said, her eyes shining with excitement. “I know how transformative that moment can be, and I want to help as many people as I can experience that same sense of empowerment.”

Through her work, Sarah encountered individuals from all walks of life, each with their own unique financial and emotional obstacles. Some were drowning in debt, while others simply lacked the knowledge or confidence to manage their money effectively. But regardless of their starting point, Sarah approached each person with empathy, guiding them through the process of budgeting, saving, and debt reduction.

“The most important thing I try to convey is that it’s not just about the numbers,” Sarah explained. “It’s about understanding the psychological and emotional factors that shape our relationship with money. Once you can address those deeper issues, the rest starts to fall into place.”

As Sarah’s reputation grew, she began to receive invitations to speak at local events and conferences, sharing her personal journey and the strategies she had developed to achieve financial wellness. Her message resonated with audiences, who were eager to learn from someone who had walked the same path and emerged stronger for it.

“I never thought I’d be standing up in front of a room, talking about my personal finance,” Sarah laughed. “But if my story can inspire just one person to take that first step, then it’s all been worth it.”

A Future Filled with Possibility

These days, Sarah’s life looks vastly different from the days when she was drowning in debt and consumed by financial anxiety. Her savings account is healthy, her credit card balances are low, and she can comfortably cover her monthly expenses without the constant worry.

But more importantly, Sarah has found a newfound sense of peace and fulfillment. The anxiety that once plagued her has been replaced by a feeling of empowerment and control, and she’s no longer defined by her financial challenges but by the progress she’s made.

“It’s amazing how much my overall well-being has improved,” Sarah reflected. “I used to dread opening my bank statement or checking my credit card balance, but now, I actually enjoy sitting down and reviewing my personal finance. It’s like a completely different mindset.”

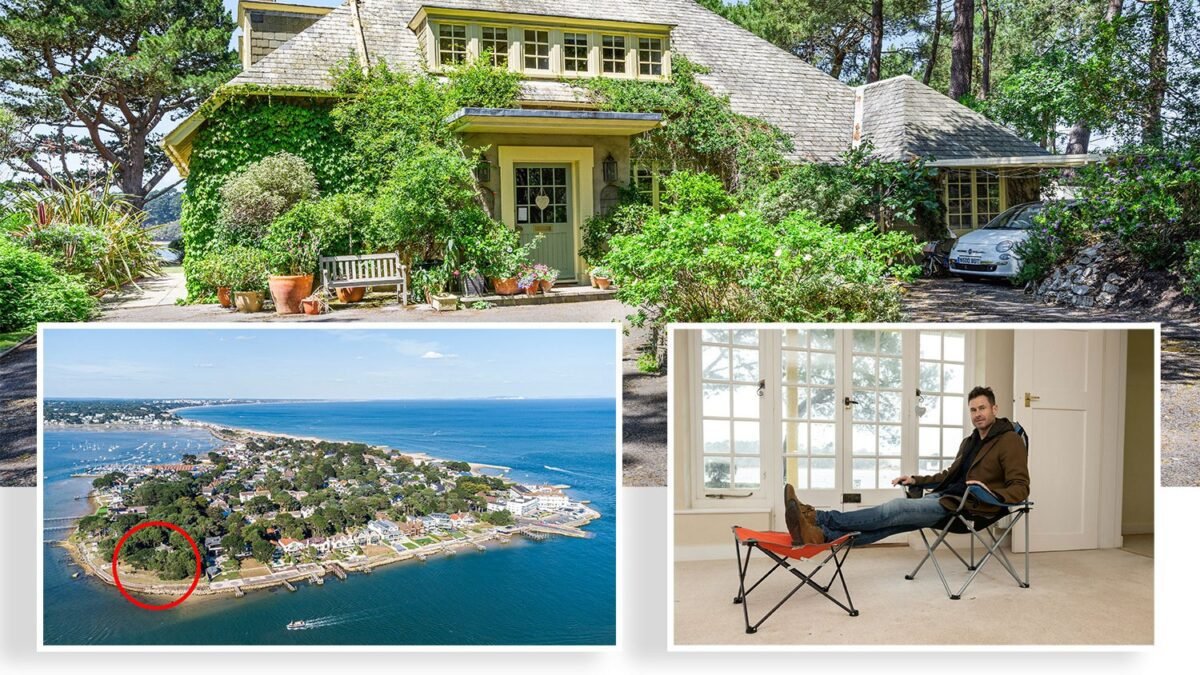

As Sarah looks towards the future, she’s excited about the endless possibilities that lie ahead. She’s exploring new investment opportunities, considering purchasing a home, and even contemplating a career change that aligns more closely with her newfound passion for financial wellness.

“I feel like I have a whole world of options open to me now,” Sarah beamed. “It’s not just about survival anymore – it’s about thriving and creating the life I truly want.”

And at the heart of it all is the knowledge that her journey to financial peace of mind has been about more than just numbers and figures. It’s been a transformative process of self-discovery, of overcoming mental and emotional obstacles, and of cultivating a healthier, more empowered relationship with money.

“If someone had told me a few years ago that I’d be standing here today, I probably wouldn’t have believed them,” Sarah admitted. “But that’s the beauty of this journey – it’s about so much more than just personal finance. It’s about reclaiming your power, your confidence, and your sense of well-being. And that’s something that’s truly priceless.”

1 Comment

[…] 10 Americans believed they needed to earn at least $100,000 annually to stop fretting about their finances. For half of those dreamers, the magic number soared even higher – $200,000 or […]

Comments are closed.