Bitcoin’s Dance with the BlackRock Devil

When BlackRock, the $10 trillion Wall Street giant, filed for a Bitcoin ETF, the crypto world cheered. Finally, mainstream adoption seemed within reach. But as the champagne bubbles fizzle, a

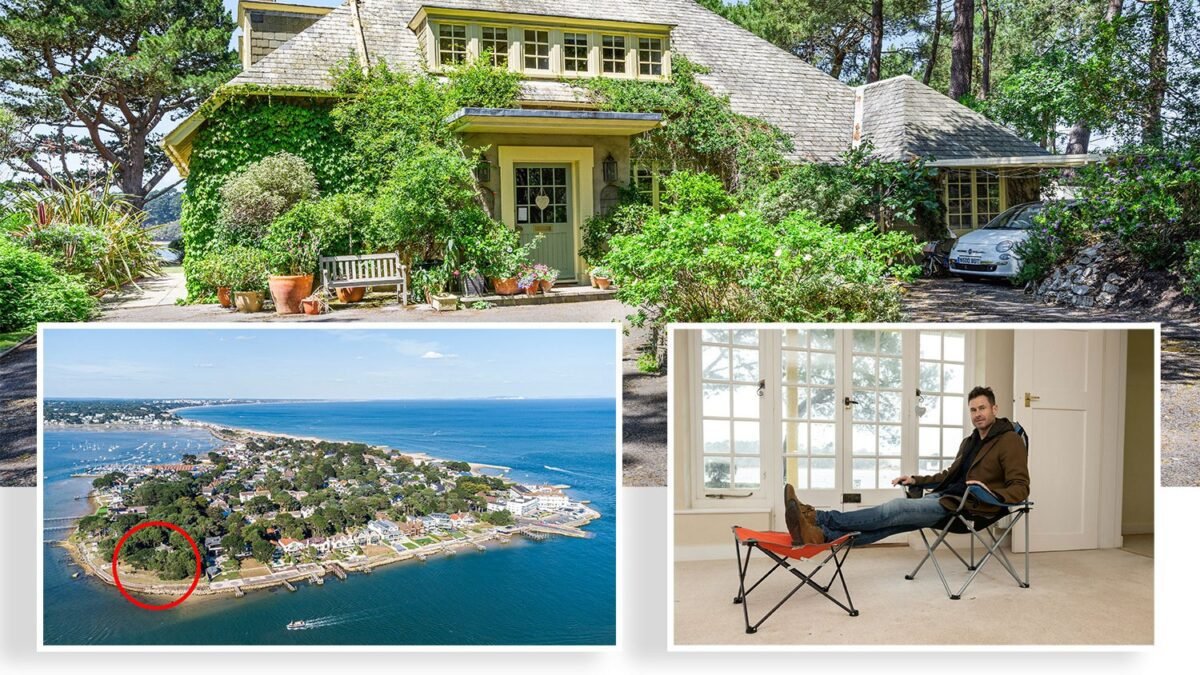

Imagine you’re standing at the edge of a vast, glittering ocean of digital gold. The waves of cryptocurrency crash against the shore, promising untold riches and financial freedom. You’ve been here before, dreaming of the day when your Bitcoin investment would change your life forever. But now, something’s different. A behemoth has entered the waters, sending ripples through the entire crypto ecosystem.

That behemoth? None other than BlackRock, the largest investment fund in the world.

Keywords: cryptocurrency, BlackRock, Bitcoin ETF, Wall Street, financial markets, investment strategy

The Bitcoin ETF: A Dream Come True… Or Is It? 🤔

When news broke that BlackRock had applied for a spot Bitcoin ETF, the crypto community erupted in celebration. After all, this was the moment we’d all been waiting for, right? The catalyst that could send Bitcoin soaring past $100,000 and beyond. It was as if the gates of Wall Street had finally swung open, inviting us all into the hallowed halls of high finance.

But as the champagne corks popped and the confetti settled, a nagging thought began to creep in: Had we just invited the fox into the henhouse?

From Ponzi to Profit: Wall Street’s 180-Degree Turn 💼

Not so long ago, mentioning Bitcoin in the boardrooms of BlackRock or JP Morgan might have gotten you laughed out of the building – or worse, fired. These financial giants had spent years deriding cryptocurrency as nothing more than a glorified Ponzi scheme. Their stance was clear: “Avoid at all costs.”

But oh, how the tables have turned.

With BlackRock’s sudden embrace of Bitcoin, the crypto taboo has vanished faster than your gains in a bear market. Suddenly, every hedge fund manager with a pulse is scrambling to get a piece of the digital pie. After all, if the most powerful financial company in the world is jumping in, who are they to resist?

The Bull Run of Our Dreams… Or Nightmares? 📈😱

Everything seems to be aligning for what could be the most spectacular bull run in crypto history. Bitcoin enthusiasts are practically salivating at the prospect. But here’s the twist, dear reader: Sometimes, you need to be careful what you wish for.

We may have been cheering for the arrival of the evil empire to Bitcoin. And now that they’re here, we’re about to learn a harsh lesson in the old adage, “Be careful what you wish for.”

BlackRock: The Secret Puppet Master of Global Finance 🕴️

While we’ve been busy watching governments and politicians, thinking they were pulling the strings, companies like BlackRock have been the true puppet masters all along. They don’t just influence elections; they make kings. They don’t just lobby for laws; they write them.

Remember all that ESG chatter that was giving Bitcoin mining such a bad rap? Guess who started that particular wildfire? That’s right – BlackRock. But now that they’ve got skin in the game, suddenly ESG is a term they’d rather not discuss. Funny how that works, isn’t it?

The Art of the Long Con: From FUD to FOMO 🎭

It’s a tale as old as time, or at least as old as financial markets. BlackRock and its ilk spread FUD (Fear, Uncertainty, and Doubt) like it’s going out of style, driving prices down and scaring off the little guys. Then, once they’ve filled their coffers at bargain-basement prices, they pull a complete 180. Suddenly, they’re Bitcoin’s biggest cheerleaders, and the FOMO (Fear of Missing Out) they generate sends prices skyrocketing.

It’s almost admirable, in a supervillain sort of way.

The Price of Progress: What We Stand to Lose 💔

BlackRock’s entry into the Bitcoin market promises to make early adopters richer than their wildest dreams. But at what cost?

This is the company that profits from both sides of wars – the destruction and the rebuilding. They embody everything Bitcoin was created to fight against: centralized power, manipulation of markets, and the prioritization of profits over people.

The Devil’s Bargain: Wealth vs. Ideals 🤑 vs. 🧠

So here we are, standing at a crossroads. On one path lies unimaginable wealth, courtesy of BlackRock and its Bitcoin ETF. On the other, the original vision of Bitcoin: a decentralized, democratic financial system free from the manipulations of the powerful.

Can we have both? Or have we made a deal with the devil, trading our ideals for a shot at the big time?

The Road Ahead: Navigating the New Crypto Landscape 🗺️

As we move forward into this brave new world of mainstream crypto adoption, we must remain vigilant. Yes, the Bitcoin ETF may send prices soaring, but we cannot lose sight of the principles that brought us here in the first place.

Here are some steps we can take to stay true to the spirit of cryptocurrency:

- Support decentralized projects: Don’t put all your eggs in the Wall Street basket.

- Educate yourself: Understand the technology and economics behind crypto.

- Engage in governance: Participate in DAOs and other decentralized decision-making processes.

- Spread adoption: Encourage real-world use of cryptocurrencies, not just speculation.

- Stay critical: Question the motives of big players entering the space.

A Call to Action 🎤

As we stand on the precipice of a new era in cryptocurrency, let’s not forget why we’re here. Bitcoin and its brethren were created to challenge the very system that BlackRock represents. Yes, their entry into the market may make us rich beyond our wildest dreams. But wealth without purpose is hollow.

So, fellow crypto enthusiasts, I challenge you: As the price of Bitcoin climbs and your portfolio swells, ask yourself – what will you do with your newfound wealth? Will you use it to perpetuate the old system, or will you invest in the decentralized future we’ve all been dreaming of?

The choice, as always, is yours. Choose wisely. 💎🙌

What are your thoughts on BlackRock’s entry into the Bitcoin market? Are you excited about the potential gains, or worried about the implications? Share your opinions in the comments below!