America’s Debt Dilemma: Why More Debt Could Be the Key to Financial Stability

In America's Debt Dilemma, the surprising truth emerges: excessive credit card debt can be as dangerous as the $17 trillion owed. Discover the real risks!

The $17 Trillion Bombshell: Is It Really What It Seems?

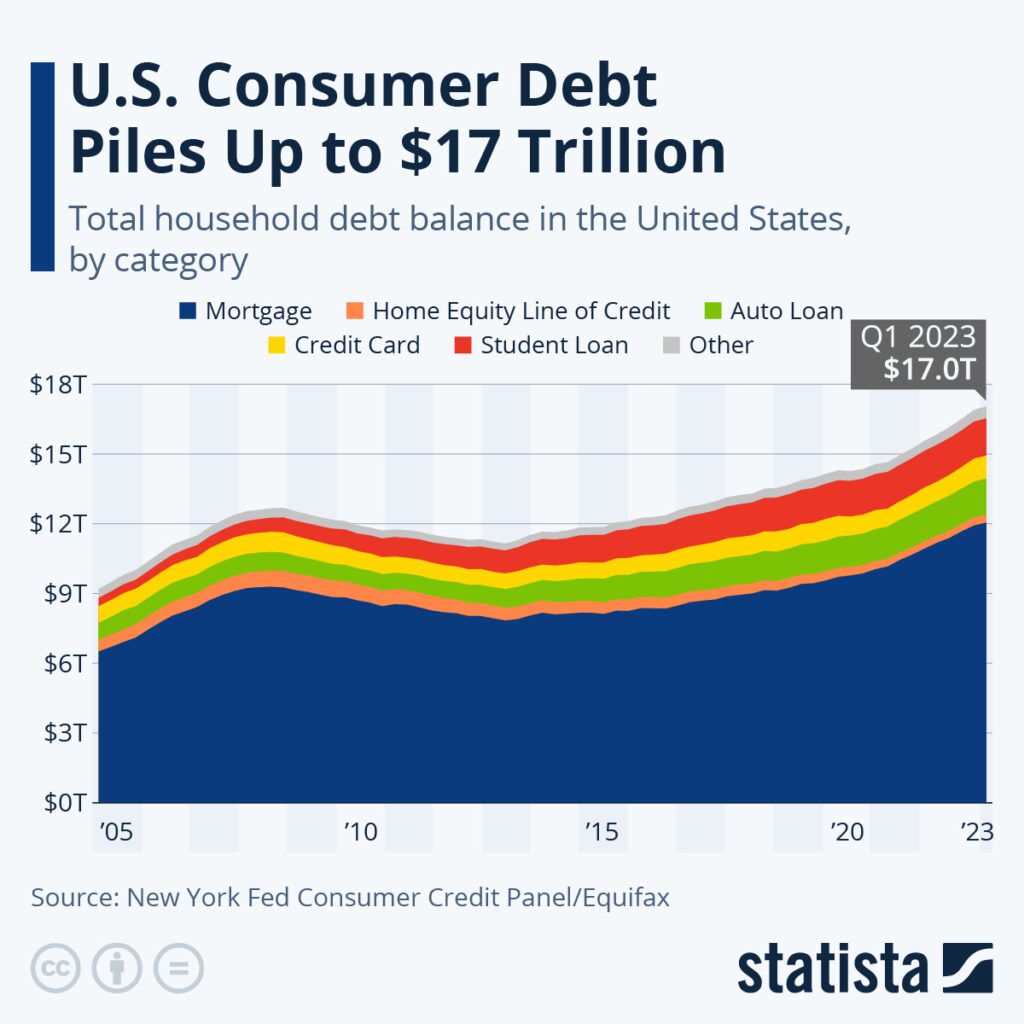

Brace yourself for a shock: American consumers have racked up a staggering $17 trillion in debt. That’s trillion with a ‘T’ – a number so large it’s hard to wrap our minds around. It’s enough to make anyone’s palms sweat and heart race. But before you reach for the panic button, let’s take a closer look at this financial Goliath.

Imagine you’re watching a magician perform a trick. The $17 trillion debt is the flashy distraction, the sleight of hand that draws your eye. But the real magic – or in this case, the real story – is happening where you’re not looking.

The Inflation Illusion: When Big Numbers Shrink

Here’s where things get interesting. When we adjust for inflation, that mountain of debt starts to look more like a molehill. In fact, total household debt has grown just 3% since late 2019. It’s like watching a time-lapse video of a glacier – sure, it’s moving, but at a pace that’s hardly panic-inducing.

But don’t relax just yet. While the overall debt picture might not be as grim as it first appears, there’s a plot twist lurking in the details.

Credit Cards: The Double-Edged Sword

Now, let’s talk about the elephant in the room – or should I say, the plastic in your wallet. Credit card debt has surged by 11% in the past year, outpacing overall debt growth by nearly three times. It’s as if consumers are reaching for their credit cards like a drowning person grasps at a life preserver.

But here’s the twist: this credit card frenzy isn’t just about splurging on luxuries. It’s a symptom of a larger problem – a debt drought.

The Debt Drought: When Borrowing Options Run Dry

Imagine you’re in a desert, parched and desperate for water. In the financial world, consumers are experiencing a similar thirst – but for accessible credit. Personal loans, once a refreshing oasis for those looking to consolidate high-interest debt, have slowed to a trickle.

Why? It’s all about the Benjamins – or more specifically, the cost of those Benjamins. As interest rates climbed, many lenders tightened their purse strings, leaving consumers high and dry. The growth in personal lending has dramatically slowed, with total balances increasing by just $14 billion year-over-year in the second quarter, compared to a whopping $46 billion surge in the same period of 2022.

Home Sweet (Equity) Home: The Untapped Gold Mine

Here’s a plot twist worthy of M. Night Shyamalan: Americans are sitting on a record $11.5 trillion in home equity. That’s right, there’s a fortune hiding in plain sight, locked away in the very walls around us.

But accessing this treasure trove isn’t as simple as waving a magic wand. High credit score requirements have turned home equity lines of credit (HELOCs) into an exclusive club, leaving many homeowners pressing their noses against the window, unable to get in.

Despite this barrier, HELOC balances have risen 20% since the end of 2021. It’s like watching a exclusive party from the sidewalk – you can see the fun happening, but only a select few get to join in.

The Refinancing Riddle: When Lower Isn’t Always Better

Remember the good old days of rock-bottom mortgage rates? Many homeowners are clinging to those rates like a child clutches a favorite toy. The thought of refinancing to tap into home equity feels like trading in a sports car for a bicycle – it just doesn’t make financial sense.

This reluctance creates a paradox: homeowners are equity-rich but cash-poor, unable to access their wealth without taking on significantly higher interest rates. It’s like having a safe full of gold but forgetting the combination – the wealth is there, but just out of reach.

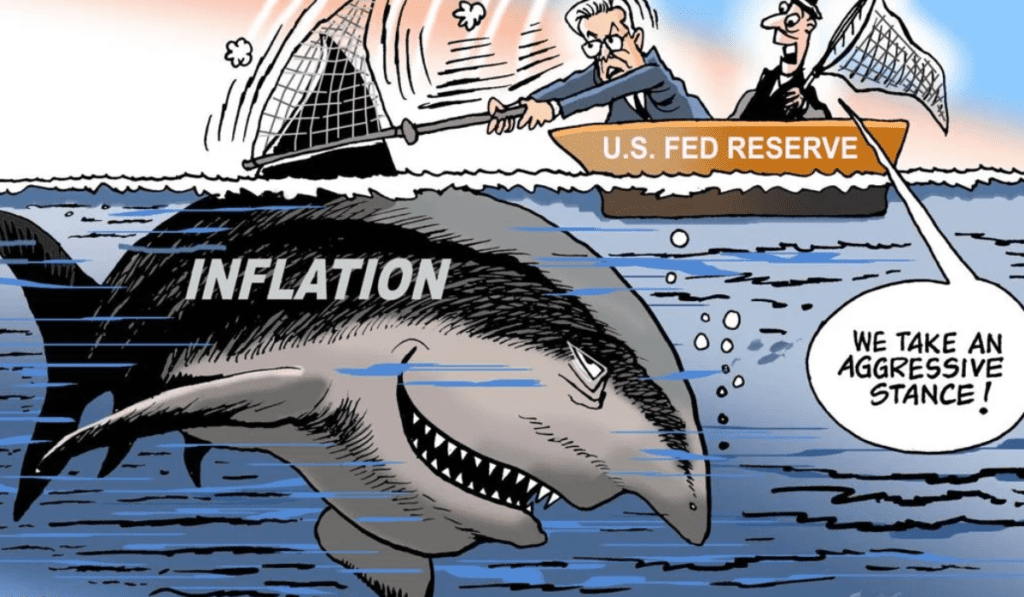

The Fed’s Magic Wand: Can Rate Cuts Save the Day?

As we reach the climax of our financial thriller, all eyes turn to the Federal Reserve. Like a wizard contemplating a powerful spell, the Fed is considering interest rate cuts. But will this magic be enough to conjure up the right kind of debt and rescue consumers from their credit card dependencies?

Lower interest rates could be the key to unlocking a variety of borrowing options. Imagine a world where personal loans become accessible again, where homeowners can tap into their equity without fear, and where credit cards return to being a convenience rather than a necessity.

The Plot Twist: When More Debt Might Be the Answer

Here’s where our story takes an unexpected turn. In a world obsessed with paying down debt, could the solution actually be… more debt? But not just any debt – the right kind of debt.

Think of it like a financial chess game. Sometimes, to win, you need to sacrifice a pawn (taking on some debt) to protect your queen (your overall financial health). The right kind of debt, at the right time, can be a powerful tool for managing finances, consolidating high-interest obligations, or investing in your future.

For example, using a personal loan to pay off high-interest credit card debt can save hundreds or even thousands of dollars in interest over time. It’s like using a bucket of water to put out a small fire before it becomes an inferno.

The Ripple Effect: How Consumer Debt Impacts the Economy

But this isn’t just a story about individual wallets – it’s a tale that affects the entire economy. Consumer spending, fueled in part by accessible credit, is the engine that drives economic growth. When consumers struggle to access affordable credit, it’s like trying to drive a car with sugar in the gas tank – things start to sputter.

On the flip side, when consumers have access to the right kinds of debt, it can stimulate economic activity. Home improvements financed by HELOCs create jobs. Personal loans used for debt consolidation free up cash flow, which can then be pumped back into the economy.

The Cliffhanger: What’s Next for America’s Debt Story?

As our tale draws to a close, we’re left with more questions than answers. Will the Fed’s rate decisions unlock new borrowing avenues? Can consumers find their way out of the credit card labyrinth? And most importantly, will America’s debt story have a happy ending?

One thing’s for certain: the next chapter in this financial saga promises to be a page-turner. The decisions made by policymakers, lenders, and consumers in the coming months will shape the economic landscape for years to come.

The Moral of the Story: Balance is Key

If there’s a lesson to be learned from America’s debt dilemma, it’s this: balance is everything. Just as a tightrope walker needs to find the perfect equilibrium to cross safely, consumers need to strike a balance between avoiding excessive debt and leveraging the right kinds of credit to improve their financial health.

Remember, in the complex world of personal finance, things are rarely as they seem. Sometimes, the path to financial health isn’t about avoiding debt entirely, but about finding the right balance. After all, in the grand tapestry of economics, a little thread of debt might just be what holds everything together.

Stay tuned, stay informed, and most importantly, stay financially savvy. Your wallet will thank you for it.

In this twisted tale of debt and credit, the true villain isn’t debt itself, but rather the lack of access to the right kinds of debt at the right times. As we’ve seen, too little of the right kind of debt can be just as problematic as too much of the wrong kind.

So the next time you hear alarming headlines about consumer debt, remember to look beyond the numbers. The real story, as always, is in the details. And in those details, you might just find the key to your own financial success story.

4 Comments

[…] “If only I made $100,000 a year,” he muttered, echoing a sentiment shared by millions of Americans. […]

[…] Finance September 22, 2024 […]

[…] Finance September 22, 2024 […]

[…] Finance September 22, 2024 […]

Comments are closed.